Learn Xero in 4 Weeks

One class per week

50% discount €500 €250 for IBAT students

50% discount €500 €250 available to all past Bookkeeping and Payroll students.

Enquire Now

Why Xero?

Xero has built a reputation for being the key choice of accounting software for start-ups and small businesses in Ireland due to its ease of use and versatility on all levels. "Accountant Online" and "Best in Ireland" have ranked Xero as the best accounting solutions in Ireland.

Xero has a very user-friendly and intuitive interface that assists with multiple tasks and easy exploration of all its core features; it also provides multiple dashboards that are easily accessible, it can display key information at a glance with widgets that show you snapshots of your bank balances, invoices owed, total cash in and out, outstanding bills, tasks, and more. One unique thing about Xero's dashboard is that these widgets are movable, so you can organize the display to your liking.

The IBAT Bookkeeping and Payroll Diploma courses provided the theory behind book-keeping and payroll, and used Sage 50 and Sage Payroll for the practical elements; also to study and practice you needed to download the Sage software to your laptop or desktop, which only worked on a Windows computer; Xero is a cloud-based solution, so it can be accessed anywhere/anytime/any-device, and without the hassle or worry about storage and back-up.

This Xero course has a shorter duration time and assumes the underlying theory of bookkeeping and payroll is already known, so the applied focus of this course will be exclusively on the Xero application.

With this course, you will also benefit from live sessions with our expert tutors teaching online in real-time, or face-to-face in the classroom, offering maximum flexibility with your time and how you learn.

Enquire Now

Key Facts

Delivery:

Live Online

Study mode:

Part-time

Intakes:

20th October

Duration:

4 weeks, one evening per week (6.30pm-9.30pm)

Evenings:

Thursday

Fees:

50% discount €500 €250 available to all past Bookkeeping and Payroll students.

This Xero course will provide you with the ability to use the Xero application to create, record and track a variety of financial transactions and records for an organisation.

You will learn how to navigate Xero, create customisable dashboards, focusing in on key metrics for the various accounting cycles. Within this, you will learn how to carry out a variety of tasks relevant to the revenue, payment and payroll cycles.

This Xero course will show you how to:

- Recording business transactions appropriately (receipts, payments, etc)

- Customising and generating invoices, bills, credit notes and purchase orders, etc

- Calculating, processing and paying staff members

- Managing customers and suppliers

- Managing the sales cycle

- Managing the purchasing cycle

- Managing inventory and assets

- Banking; bank payments and receipts, bank reconciliation

- Running and analysing financial reports on business performance

You will also be introduced to Xero impressive selection of tools that will help you manage your finances and run your business, these include:

Xero - Introduction

- Xero - Introduction

Xero - Getting Started

- Xero - Introduction – Getting Started

- Xero - Signing up to Xero

- Xero - Quick Tour of Xero

- Xero - Initial Xero Settings

- Xero - Chart of Accounts

- Xero - Adding a Bank Account

- Xero - Demo Company

- Xero - Tracking Categories

- Xero - Contacts

Xero - Invoices and Sales

- Xero - Introduction – Invoices and Sales

- Xero - Sales Screens

- Xero - Invoice Settings

- Xero - Creating an Invoice

- Xero - Repeating Invoices

- Xero - Credit Notes

- Xero - Quotes Settings

- Xero - Creating Quotes

- Xero - Other Invoicing Tasks

- Xero - Sending Statements

- Xero - Sales Reporting

Bills and Purchases

- Xero - Introduction – Bills and Purchases

- Xero - Purchases Screens

- Xero - Bill Settings

- Xero - Creating a Bill

- Xero - Repeating Bills

- Xero - Credit Notes

- Xero - Purchase Order Settings

- Xero - Purchase Orders

- Xero - Batch Payments

- Xero - Other Billing Tasks

- Xero - Sending Remittances

- Xero - Purchases Reporting

Xero - Bank Accounts

- Xero - Introduction – Bank Accounts

- Xero - Bank Accounts Screens

- Xero - Automatic Matching

- Xero - Reconciling Invoices

- Xero - Reconciling Bills

- Xero - Reconciling Spend Money

- Xero - Reconciling Receive Money

- Xero - Find and Match

- Xero - Bank Rules

- Xero - Cash Coding

- Xero - Remove and Redo vs Unreconcile

- Xero - Uploading Bank Transactions

- Xero - Automatic Bank Feeds

Xero - Products and Services

- Xero - Introduction – Products and Services

- Xero - Products and Services Screen

- Xero - Adding Services

- Xero - Adding Untracked Products

- Xero - Adding Tracked Products

Xero - Fixed Assets

- Xero - Introduction – Fixed Assets

- Xero - Fixed Assets Settings

- Xero - Adding Assets from Bank Transactions

- Xero - Adding Assets from Spend Money

- Xero - Adding Assets from Bills

- Xero - Depreciation

Xero - VAT Returns

- Xero - Introduction – VAT Returns

- Xero - VAT Settings

- Xero - VAT Returns – Manual Filing

- Xero - VAT Returns – Digital Filing

Assessment

You will be required to successfully complete a project.

What is a Professional Diploma?

An IBAT Professional Diploma is a focused, short duration practical course that consolidates, upskills and/or reskills learners in a professional area. They are stand-alone qualifications that do not lead to an award on the National Framework of Qualifications (NFQ).

This Xero course is ideal if you are interested in learning about Xero, or are looking to switching over to Xero.

Additional advantages include:

- Xero has connections with various well-known banks such as Bank of Ireland, AIB, Ulster Bank, HSBC, RBS, NatWest, Barclays and many others.

- Easy integration with Stripe, TransferWise and PayPal, among others.

- The Xero-Me mobile app acts as a self-service portal for employees.

- Facilitates over 160 currencies, automatic currency conversions needed for international trade.

- Easy track and trace history & notes to see who made what changes and when they were made.

Meet Our Tutors

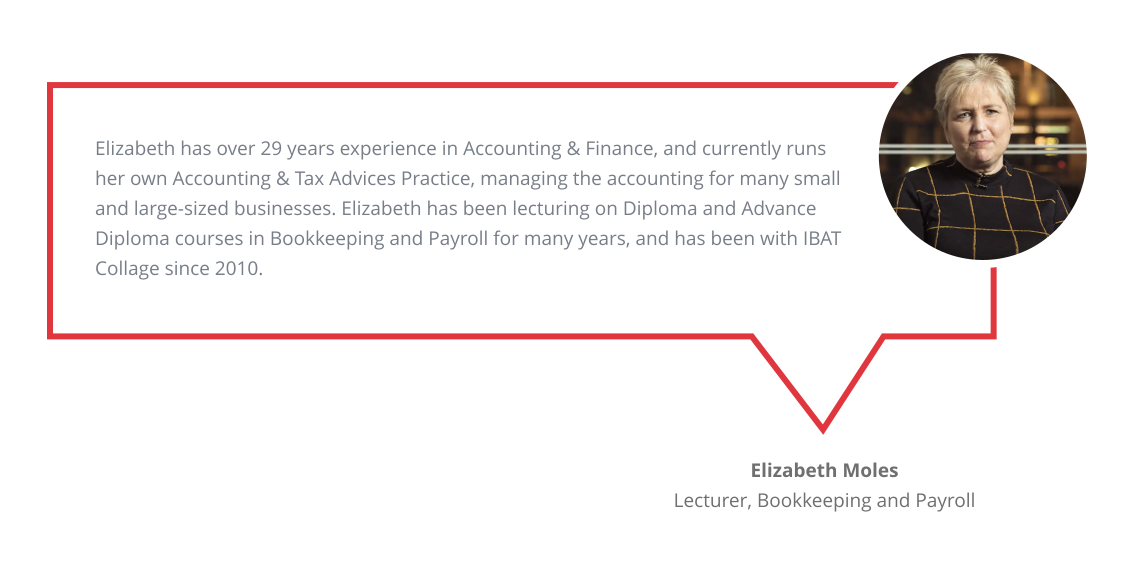

Meet Elizabeth Moles

Meet Laura Flynn

Meet Our Graduates

Meet Ramune Gailius, Diploma in Bookkeeping and Payroll Graduate

Meet Esther Hill, Diploma in Bookkeeping and Payroll Graduate

Why IBAT?

IBAT is committed to providing students with high-quality education and an excellent study experience. To achieve this, IBAT’s programmes are taught by industry-experts and in small class sizes to ensure each student can ask questions and flourish academically.

Our Dublin campus is based in the city centre, in Temple Bar. Dublin is a city full of culture, with an abundance of live music and many fascinating historical landmarks to visit.

Since 2016, IBAT has been part of the Global University Systems group. This has allowed the college access to an international audience in more than 60 countries. IBAT has also been able to extend the programmes it offers by working with GUS partners.

Our students have access to our state-of-the-art campus which is purpose built. IBAT also offers an extensive amount of student support to ensure you reach your goals.